Australia’s large cities are facing extraordinary population growth pressure, with symptoms manifesting themselves in everything from shortages of housing to health care, education, transport and other forms of essential infrastructure. This pressure is fuelled almost entirely due to Federal Government immigration policy.

The situation is exacerbated due to our historic reliance on a small handful of cities to accommodate our population: 70% of Australians live in our 8 largest cities. By comparison, in the USA their 10 largest cities account for just 26% of their total population. To get to 70% of the population of the United States, you would need to include 120 of their largest cities, not 8.

Source: author research

In Australia, by the time you are outside our top 5 cities, you start to encounter cities of 500,000 people. By the time you get near #10, you are essentially at a rounding error for Melbourne or Sydney. The curve drops off sharply in Australia, while in the USA there are many cities of 1 million or more and the curve is less pronounced, especially once you exclude the global mega city region of wider New York.

The focus on our largest cities getting larger is unlikely

to change without some policy interventions (more on that in part two of this).

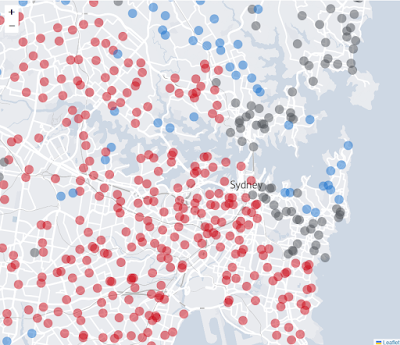

For the time being, the largest cities are perceived by locals and immigrants

alike to offer the greatest opportunities for employment, education, health

care and general amenity. This explains why immigrants are overwhelmingly

choosing to settle there.

Ironically, as the large cities get more and more crowded these perceived benefits are increasingly compromised: housing costs are escalating, traffic is worsening, and access to social infrastructure gets harder. The impression however hasn’t changed the preference to settle in these large cities, despite the obvious drawbacks in housing – to the extent that our housing affordability now ranks as some of the worst in the developed world relative to incomes.

Why Australia isn’t developing a number of second tier cities capable of reducing the pressure on the major capitals is nothing new. As City Growth Strategist & Economic Geographer George Wilkinson III pointed out in his chapter in “The Next Australian City” by Suburban Futures, even on the eve of Federation in 1901, “it was contended that the capitals were congested cesspools with state centralisation being a regrettable outcome.” To entice reluctant regional votes over the line, it was promised that Federation would herald an era of decentralisation. It didn’t.

None of this is to deny that many regional cities are

experiencing solid growth relative to their size. The average growth over ten

years for the largest cities (Melbourne, Sydney, Brisbane and Perth) was 20%. Many

regional centres grew just as fast or faster in that time. Places like Geelong

(Vic), Busselton (WA), Ballarat (Vic) and Toowoomba (Qld) for example are just

some of the regional cities which grew by significant percentages in the 10

years to 2024.

But if you exclude the actual growth numbers in places like

the Gold Coast-Tweed (135,624) or Sunshine Coast (91,202) there are not many

regional cities growing by significant numbers of people despite the high

percentages: they are coming from a relatively small base. Busselton’s 25%

growth for example only represents an additional 9,036 people. That pace of

growth will still pose a challenge for the local council tasked with

accommodating it, but in real numbers it’s not going to help relieve the

pressure we are placing on the larger capitals. In the same period Busselton

grew by 9,000 people for example, Brisbane grew by nearly half a million

people.

Australia lacks any form of settlement strategy, something the Planning Institute of Australia has repeatedly argued for: “When it comes to planning strategy, we need a greater focus on place-based infrastructure planning and funding, common infrastructure demand and population scenarios to make a real change.” Hear hear.

As our major capitals hurtle toward an uncertain future

driven by growth they have no control over and with limited resources, it is timely

to ask why more isn’t being done to explore opportunities to spread the population

load more equitably. Are there centres in Australia capable of accommodating

many more people than they have at present? Are there opportunities to nurture

a series of second tier cities of between 300,000 and 1 million, where opportunities

for employment, housing, health care, education and environmental amenity are

at least as good as those found in the major centres? If so, where would you

start, and what levers are at our disposal?

Part two will explore some ideas.