Sunday, February 24, 2019

Deconstructing the Brisbane CBD

What’s it going to take to reignite the demand for Brisbane CBD offices? From an employment point of view, the answer could be surprisingly little. But first, it helps to ask what types of jobs make the CBD jobs market tick. Only around 60% of the foot traffic we see in the CBD is making its way to or from a workplace in an office building, so understanding how this 60% is different from the rest is a good starting point to understanding drivers of future demand.

In the case of Brisbane, the most accurate record of the number of workers in the CBD is the Census. For 2016, it showed 122,486 people called the CBD their place of work. Of these, 92,118 were full time – the rest part time or otherwise classified.

But what do they all do? The presumption is that CBD workers are in office jobs. But only some are. Of the 122,486 going to work in the CBD, there were 2,015 cleaners, 819 in food preparation, 7,019 sales workers, 3,462 working in hospitality, 3,795 managers of hospitality and retail services, 2,454 protective service workers, 1,212 health professionals, 2,103 educators, and a range of other occupations - including 16 who called themselves farmers and farm managers, 43 gardeners and 101 "skilled animal and horticultural workers."

These types of occupations are also more likely to have high proportions of part time or casual workers. These also aren’t the types of occupations likely to leasing space in office towers. For that, we need to look to occupations like the 1,726 CEOs and GMs, the 12,286 specialist managers, the 19,472 business, HR and marketing professionals, the 6,490 design, engineering, science and transport professionals, the 7,243 information and communication professionals, the 6,782 legal professionals, the 2,778 engineering, ICT and science technicians, and the 30,441 clerical and admin workers. These are also more likely to be full time in nature. That collection of occupations gets us to around 90,000 – which is what I’d consider roughly the number of workers who occupy the various office buildings in the Brisbane CBD.

A quick reality check is found in the Property Council’s office market report which for mid 2016 (when the Census was conducted) showed 1,880,451m2 of occupied space (that is total stock less total vacancies). Divide the occupied space by the 90,000 and you get 21 square metres per person. Allowing for empty desks in leased offices and various blocks of surplus but unlettable space, that sounds about right. (Quoted workspace ratios of below 15m2 per person are typically in fully occupied demonstration projects only and not typical of the entire market).

The Census also tells us that 10,062 CBD workers (full and part time) were employed by the Federal Government, some 25,902 by the State and 2,681 by Local Government. State Government numbers since then have escalated significantly, helping drive demand for more office space.

In addition to these workforce numbers, there were around 9,640 people who called the CBD ‘home’ (it’s where they live) and a further 4,556 visitors (most of who would have been in hotels or serviced apartments – not including overseas visitors who aren’t counted in the Census), plus there’s around 4,000 students. Workers, residents, visitors and students all blend together and become part of the CBB mass of people. Put the workforce, residents, overnight visitors, students all together and you get a total of 140,000 people. Add in an allowance for day trippers and international visitors (neither of which are counted in the Census) and you get to a theoretical 150,000 or 160,000 people a day.

But if you’re in the business of filling office towers then residents, visitors and students aren’t of much interest. You need lawyers, accountants, engineers, marketing and HR professionals, designers, IT and communication professionals and of course the admin workers that support them. By how much do these occupations need to grow to support renewed demand for more office towers?

Let’s go back to our guesstimate of 90,000 office workers occupying roughly 20m2 of office space each. If there was 10% growth in these occupations, that would mean another 9,000 jobs or potentially 180,000m2 of new demand needing to be satisfied. You could adopt a more conservative 15m2 per person (which you might find in a new tower as opposed to across all grades of space across the entire market) and that 10% growth still gives you 135,000m2 of new demand.

This starts to sound promising. Of course, there’s still some 350,000 square metres of space in existing buildings available for lease, which will take up a proportion of any new demand from employment growth. But it does start to take the edge off the dimensions of market growth in office employment needed to see new towers rise out of the ground.

It’s been this type of CBD employment growth that explains why Melbourne has close to half a million square metres of new office space underway and why Sydney CBD has 200,000m2 underway. These markets are generating the types of jobs in the types of locations that will drive CBD office demand. So what’s needed to drive that sort of job growth in Brisbane?

Last time Brisbane’s CBD jobs market grew quickly, it was off the back of the resources boom (generating engineering, legal, and a variety of technical jobs). When that boom ended, the wind was sucked from the Brisbane CBD’s sails. This time around, a recovering resources sector isn’t seeing as much new investment (ask Adani about how hard that is) but rather existing mines are gearing up production – which doesn’t generate as much new job growth but does generate export earnings. The tourism sector is looking good for the State, but part-time jobs in hospitality aren’t going to drive demand for CBD office space. Building new resorts and hotels will (think designers and engineers for example), but in anything other than established urban locations, new resorts and tourism infrastructure seems to meet with a lot of hostility these days (witness the Mt Coot-tha Zip Line). Banking, finance and large accounting firms are increasingly reliant on offshoring and centralization of functions in Sydney or Melbourne – so there’s not a great deal of comfort on that front. Government jobs growth has been a saviour for the CBD in recent years but after an extended period of strong employment growth, there are questions around how sustainable this will be in the long term given Queensland’s finances. Expecting a lot more growth from Government jobs in the CBD might be expecting too much.

Health and education are two of the fastest growing industries for the foreseeable future and the investigation of and delivery of new schools, hospitals, tertiary facilities and so on will no doubt generate jobs in design, construction, legal and project management (yay). The question around many of the larger health and education projects is when the start button gets pressed. Then there’s infrastructure as potentially the next driver of demand for occupations that will fuel the need for more CBD office space. But on the infrastructure front, we are challenged by a state budget which is short of money. There has been talk of tens of billions in new infrastructure investment associated with SEQ ‘city deals’ and other initiatives but much of this remains speculative until someone finds the money.

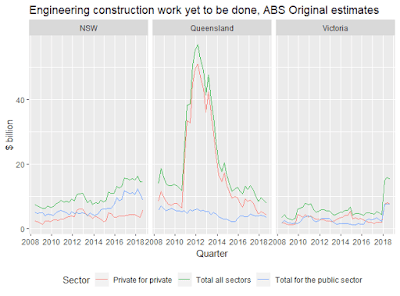

Economist Gene Tunny from Adept Economics produced this graph recently which shows the height of the infrastructure boom (driven by resource exploration and new mines) which Queensland has come from, and where we are now relative to NSW and Victoria. It’s a sobering challenge.

So on the plus side, once this investment kicks off, it’s not hard to see 10% growth in city employment generating enough demand to kick off some new office towers. On the flip side, the big question is when this will happen.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment